I previously compared FMETF with ETFs from neighboring Asian countries and found that FMETF’s total assets under management as percentage of the market capitalization of the index it tracks seems low compared to ETFs from Vietnam and Thailand. I noted that one reason may be due to the availability of mutual funds and unit investment trust funds (UITFs) that also track the same PSE Composite Index (PSEi).

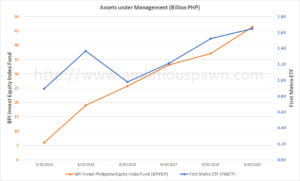

One such UITF is the BPI Invest Philippine Equity Index Fund (BPIPEIF). As of this posting, its total assets amount to almost PHP 49 billion. In comparison, FMETF has total assets amounting to PHP 1.7 billion. I then dug up the total assets of each fund over the past five years as shown in the chart. BPIPEIF has grown more than 9 times while FMETF barely doubled. Today, BPIPEIF’s assets is more than 28 times that of FMETF.

I find this a little puzzling because FMETF’s fee is just 0.50% compared to BPIPEIF’s 1% (1.5% before 2018). Conventional wisdom tells me investors would prefer the lower fee ETF. Why are billions pouring into BPI’s UITF but not to FMETF? Could BPI’s returns be higher or the same despite its higher fees? I haven’t really looked into this in detail. Is it because it’s simply easier to invest in the UITF if you’re a BPI client because you don’t need to open a separate brokerage account? After 6 years in the market, are many investors still not aware of FMETF and its lower fees? What am I missing?

I think 1. it may be the less friction to allocate funds to the BPI Index if you are already an existing client. 2. they might also have misjudged or think about the eventual financial impact of 1% fee over time.

I think most index fund subscribers do Cost Averaging so AUTOMATION is key.

BPIPEIF purchases can be automated using BPI’s RSP (Regular Subscription Plan). It’s easy to set up and perfect for busy long-term investors who’s willing to pay the extra trust fee in exchange for absolute convenience.

The only automation I know for FMETF is through COL’s EIP (Easy Investment Program). You can schedule the FMETF purchases, but automating the FUNDING of your brokerage account from your bank is another story. Open to know if there are other brokers who can automate.

Actually, can you please write about this (most cost-efficient way to automate your index fund investments)? I just saw your site today and wished I encountered it sooner! Excellent content, please keep them coming! 🙂